On March 28, 2012, I had two articles in the estate and retirement planning special section in the Register-Guard. This one was about wills, trusts, and end-of-life directives while the other was about fairly dividing your estate’s personal items. I knew nothing about these topics before writing these articles and now know how important it is to get help when planing to take care of your family after your death. Click to see the full Estate Planning PDF.

Wills? Trusts? Directives?

Estate planning takes the guesswork out of inheritance issues

By Vanessa Salvia

FOR SPECIAL PUBLICATIONS

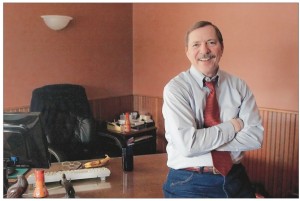

Photo by Amanda L. Smith

You’re never too young — or too old, for that matter — to get your affairs in order with the help of an estate-planning attorney. It’s certainly not a fun topic, but a necessary one, as estate planning is the only way to be sure a property will be transferred to your loved ones and/or community in the way that you wish.

The idea of estate planning is much like buying life insurance or flood insurance: You’re looking for protection against the unknown.Springfield estate planning attorney and counselor R. Scott Corey, who enjoys speaking to private groups about the topic, says many people are not sure what documents they need for estate planning.

Springfield attorney R. Scott Corey says legal counseling is key for both end-of-life directives and distributing an estate according to a person’s wishes.

“Read the obituaries for two weeks,” he tells them. “It’s a real eye-opener. People like to think, ‘It’s not going to happen to me.’”

Corey’s definition of estate planning is all-encompassing: “I want to control what I have when I’m alive and well, if I become incapacitated, and when I die, so that I give what I want to whom I want, when I want, and how I want, all in the most efficient manner.”

Kathleen, who asks to remain anonymous, lost a young husband in an accident. “I was awakened to the reality of grieving while dealing with the incredible legal mess left behind,” she says. “My husband and I had always put off making a will or estate planning — we were too young to worry about it. After remarrying, I realized how important it was to plan ahead for our new blended family. One can never plan ahead for the emotional loss of a loved one, but estate planning can remove the questions and concerns regarding the legal matters, and financially safeguard those left behind.”

Not merely a safeguard for survivors, estate planning benefits the testator, or person writing the will or trust, in the event he or she becomes incapacitated.

If a spouse or partner is a joint owner on your accounts, he or she may write checks and pay bills. But if there is no spouse or partner, or they’re not authorized to access funds, things become complicated.

“For incapacity, the solution is often a well-written durable power of attorney,” says Corey. Proper powers of attorney allow another person to make financial decisions in business, private or legal matters on behalf of the one who has become incapacitated.

A common mistake is to include a child as joint owner to pay your bills. “If you put their name on as an owner,” says Corey, “you’ve potentially exposed every account they’re on to whatever financial problems they may have.” A legal judgment against the child could put your joint assets at risk.

There are many “do-it-yourself” websites that allow people to create legal documents. Corey does not recommend this approach. “You need to understand what the documents mean, and you need good counseling as to how they work together.”

He notes that attorneys used to be called “attorneys and counselors at law.” “We used to be the family counselors. When you buy documents online (as if they were) commodities, you don’t get the counseling to explain when or how it works or when it doesn’t work. Effective planning should not be, ‘Would you like that in small, large or super size?’ You really have to understand your family dynamic to plan effectively.”

Estate planning also can help safeguard against tax pitfalls. For instance, if a child inherits your home rather than receiving it as a lifetime gift intended to avoid probate, the child will escape capital gains taxes when the property is sold.

Estate planning is like a jigsaw puzzle, and today’s blended families often make for puzzles with many pieces. A will is a critical instrument to have if you have minor children. It’s where you name the guardian who will care for your children if anything happens to you. For couples without a will or trust, the surviving spouse generally takes all.

“If you remarry without planning for your children, your new spouse gets jointly held property outright upon your death, leaving the kids asking, ‘Where’s Mom’s money?’ Mom failed to plan. She gave it to Dad, and Dad’s plan was, ‘I’m giving it to the new wife,’” Corey says.

Without planning, children receive an inheritance at age 18, even if they’re too immature to manage it. “A simple will generally doesn’t help for minors or unique planning situations,” says Corey. “A trust may be the better solution.”

A trust allows you to deal with your property and finances while you’re alive and well and during incapacity. A trust is more difficult to contest, because it relates to the settlement of the estate.

“The best way to avoid disputes is to have a plan that is clearly written out and fits together,” Corey says. “There should be no guesswork.”

No comments yet.